Reefs Club – Landmark Bermuda Hotel Sells Fractionals

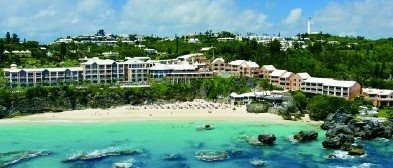

Guests of the Reefs, a 62-year old family-owned boutique luxury hotel on its own idyllic beach in Bermuda, are known for their loyalty. Some have vacationed there 20, 30 and more times. Now the Reefs is counting on loyalists as well as newcomers to buy into its 19-unit private residence club. The Reef Club -- fractional-ownership two- and three-bedroom “villas” adjoining the hotel -- are nearing completion and will open July 3. (Photo above shows what it will look like when villas are completed.)

Guests of the Reefs, a 62-year old family-owned boutique luxury hotel on its own idyllic beach in Bermuda, are known for their loyalty. Some have vacationed there 20, 30 and more times. Now the Reefs is counting on loyalists as well as newcomers to buy into its 19-unit private residence club. The Reef Club -- fractional-ownership two- and three-bedroom “villas” adjoining the hotel -- are nearing completion and will open July 3. (Photo above shows what it will look like when villas are completed.)By Bermuda standards, the 1/10th ownership furnished fractionals are “affordable” -- $350,000 for a 2-bedroom, $410,000 for a 3-bedroom. (Another 13 % is tacked on in fees, taxes and closing costs.) Full ownership condos elsewhere on this adorable, expensive island start at over $1-million, although one real estate agent, Buddy Rego, said last month that no Americans went to closing on condos anywhere in Bermuda in the first quarter of 2009.

Bermuda’s restrictive laws on non-Bermudian ownership of property keep prices high. Yes, the worldwide recession is taking its toll. Since Reefs Club fractionals were first offered, 30 out of 80 early birds who had put down “soft” $5,000 deposits have opted to pull out, according to Chrissy Frith, membership director.

Nevertheless, Reefs president David Dodwell told me that he has no plans to lower prices, although he might consider some “value-added” incentives, such as rebates on certain homeowner fees for a period of time. The villas give Reefs fans a “rare opportunity,” he said, adding that some units might be used for overflow hotel guests during peak times. The villas building will also house a much expanded spa and fitness center.

Labels: Bermuda, fractional, Reefs, Reefs Club